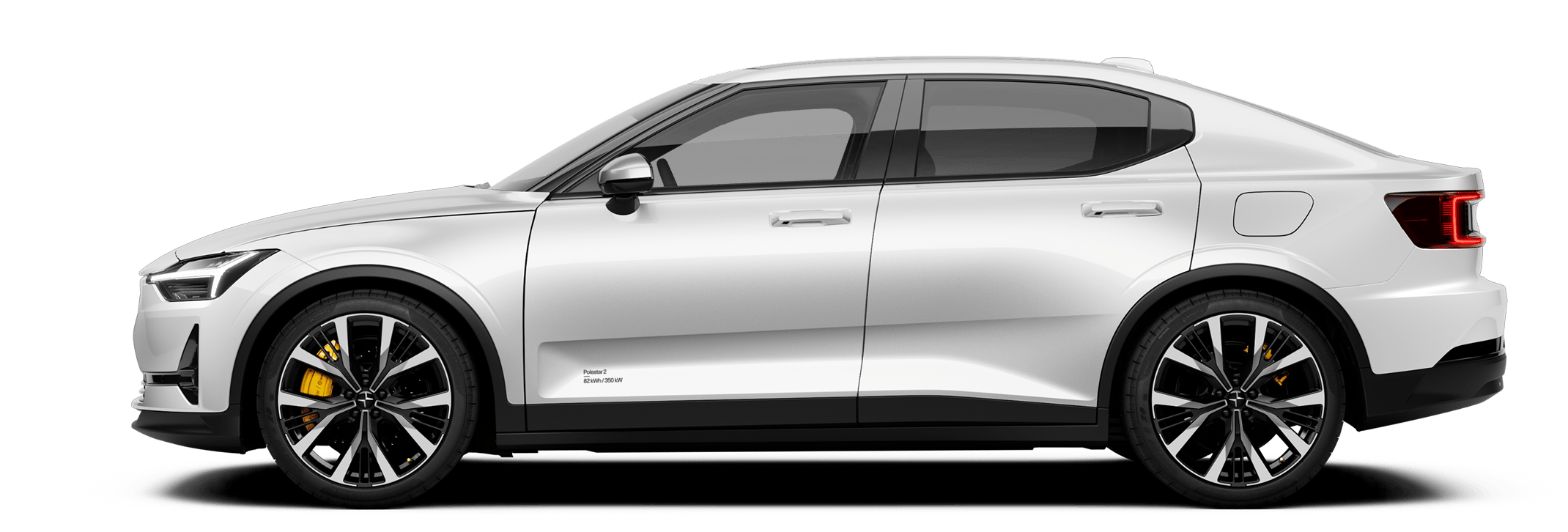

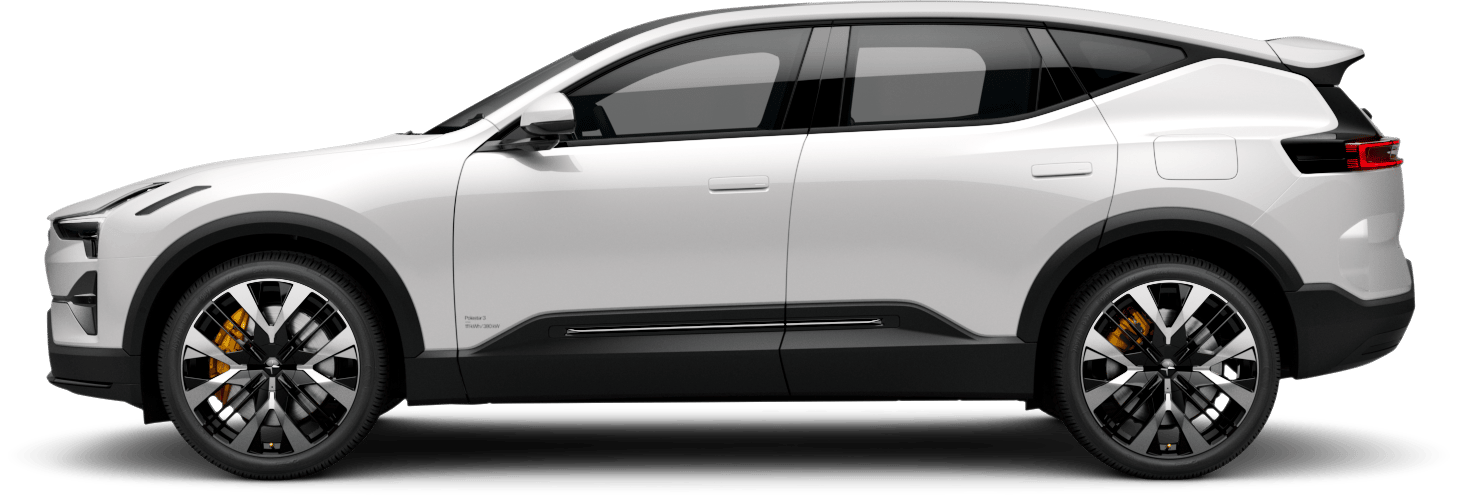

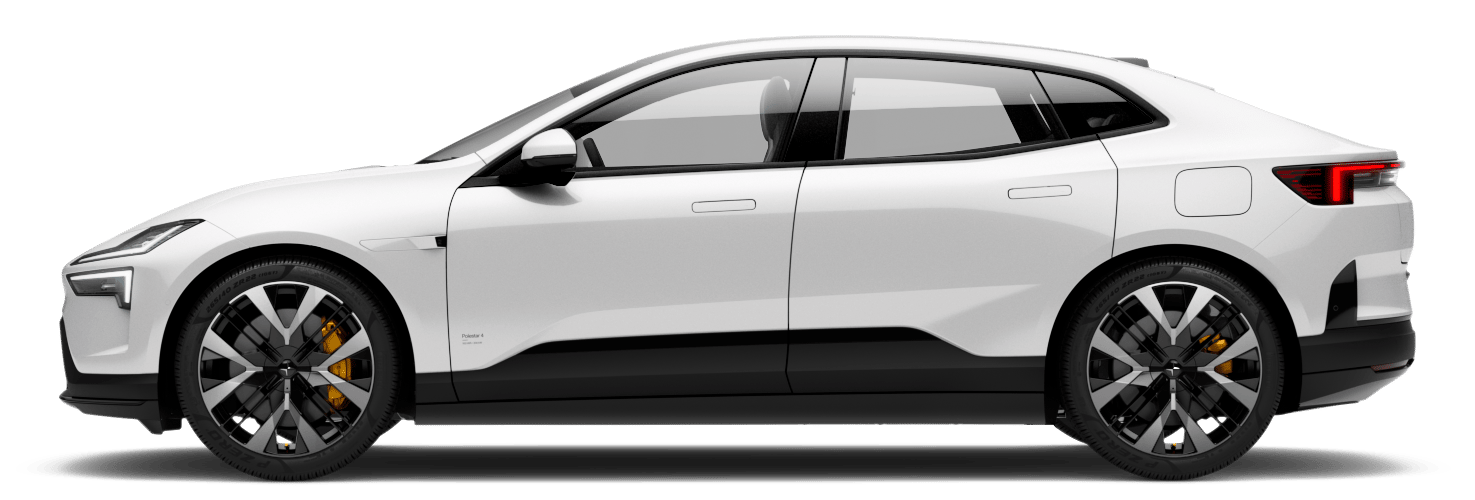

A novated lease allows you to bundle the finance and all the expected running costs of your Polestar into a single payment that’s deducted from your salary before tax, designed to save you time and money.

A novated lease allows you to bundle the finance and all the expected running costs of your Polestar into a single payment that’s deducted from your salary before tax, designed to save you time and money.

A novated lease is an agreement between you, your employer and your employers fleet company, that lets you bundle the finance and all the expected running costs of a new Polestar into a single payment. This can then be deducted from your salary, to help save you time and money.

A novated lease is an agreement between you, your employer and your employers fleet company, that lets you bundle the finance and all the expected running costs of a new Polestar into a single payment. This can then be deducted from your salary, to help save you time and money.

The obligation for payment is transferred (novated) from you to your employer who makes deductions via payroll.

The obligation for payment is transferred (novated) from you to your employer who makes deductions via payroll.

You can get a competitive price for your new Polestar, potentially pay less income tax, save GST on your running costs and are also exempt from paying FBT. Everything you'll need to keep your car on the road - including maintenance, repairs, tyres, registration, and fuel - is bundled into one regular payment to make managing your car a breeze.

You can get a competitive price for your new Polestar, potentially pay less income tax, save GST on your running costs and are also exempt from paying FBT. Everything you'll need to keep your car on the road - including maintenance, repairs, tyres, registration, and fuel - is bundled into one regular payment to make managing your car a breeze.

- 01.Less income tax

Payments are made from your salary before tax is taken out; which can reduce your taxable income and the amount of tax you pay.

- 02.GST savings

With a novated lease, there is no GST payable on the vehicle purchase price, fuel, and vehicle maintenance and repair costs.

- 03.Fringe benefit tax exemption

If you are an employer or an employee who drives an electric vehicle you may be eligible for a fringe benefit tax (FBT) exemption. For employers, this can reduce the cost of providing a vehicle to an employee, as FBT does not need to be paid. For employees, it can mean that the cost to access a vehicle may be reduced, as the FBT liability is not passed on.

Find out more - 04.Ease and convenience

Everything is covered in your salary deductions, so there’s no extra bills at registration or insurance renewal time. This is taken care of in one, consistent easy monthly payment giving you the ability to better plan your finances.

Speak to your employer to understand which Novated Leasing provider they work with.

Speak to your employer to understand which Novated Leasing provider they work with.

Here are a few of the providers who are currently offering Polestar cars through novated leasing:

Here are a few of the providers who are currently offering Polestar cars through novated leasing: