Write down allowances, sustainability credentials, and lifecycle assessments. Purchasing a Polestar through your business comes with a host of financial, tax, and sustainability benefits. Sometimes the right choice and the desirable choice are one in the same.

Write down allowances, sustainability credentials, and lifecycle assessments. Purchasing a Polestar through your business comes with a host of financial, tax, and sustainability benefits. Sometimes the right choice and the desirable choice are one in the same.

Choose a car, decide on your ideal type of finance, and enjoy the ride. Being part of the Polestar journey by purchasing through a business enables you to maximise the value of a Polestar, whilst minimising your impact. Doing so can also help you and your organisation achieve your goals around emissions, sustainable practice, and corporate social responsibility. Let’s dive into the benefits.

Choose a car, decide on your ideal type of finance, and enjoy the ride. Being part of the Polestar journey by purchasing through a business enables you to maximise the value of a Polestar, whilst minimising your impact. Doing so can also help you and your organisation achieve your goals around emissions, sustainable practice, and corporate social responsibility. Let’s dive into the benefits.

2% Benefit-in-kind tax

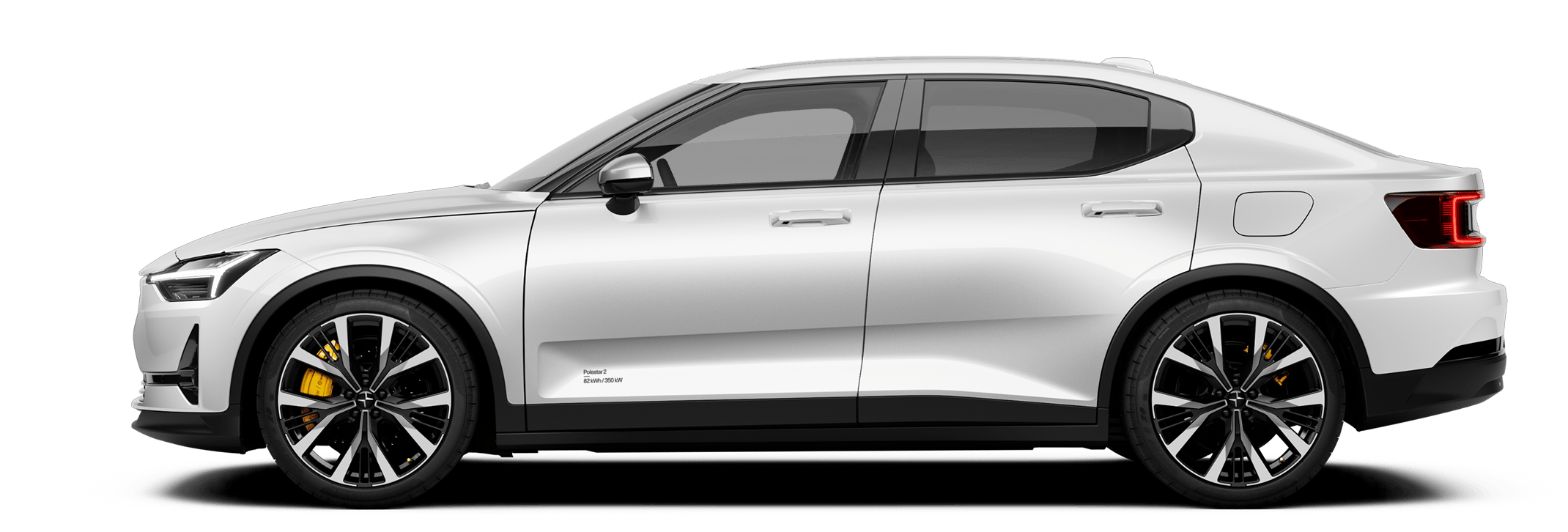

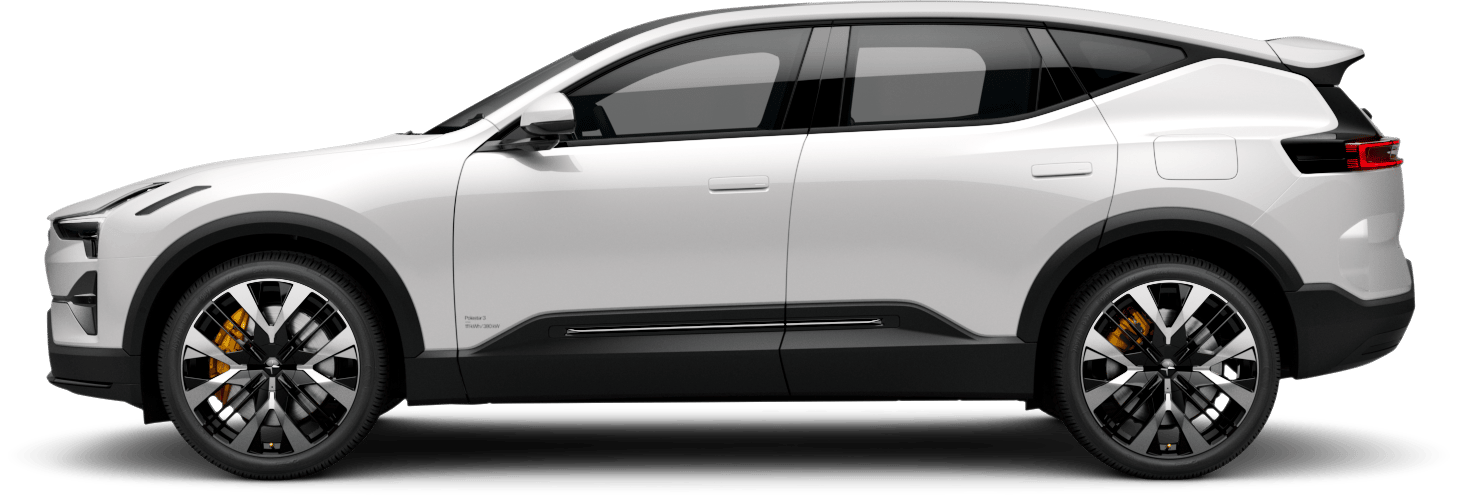

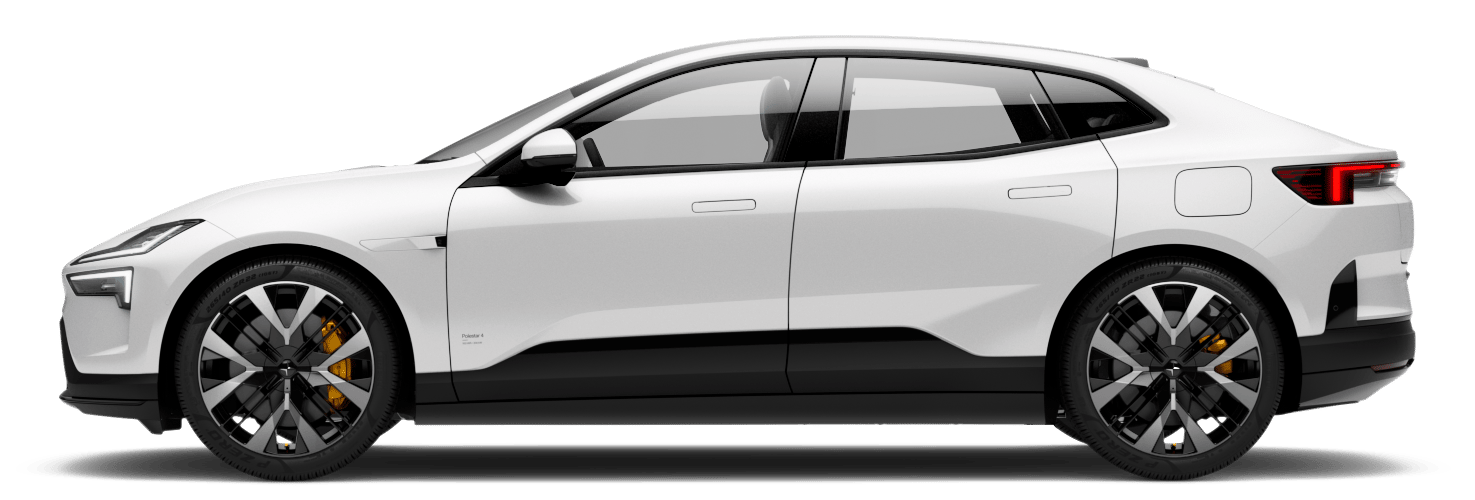

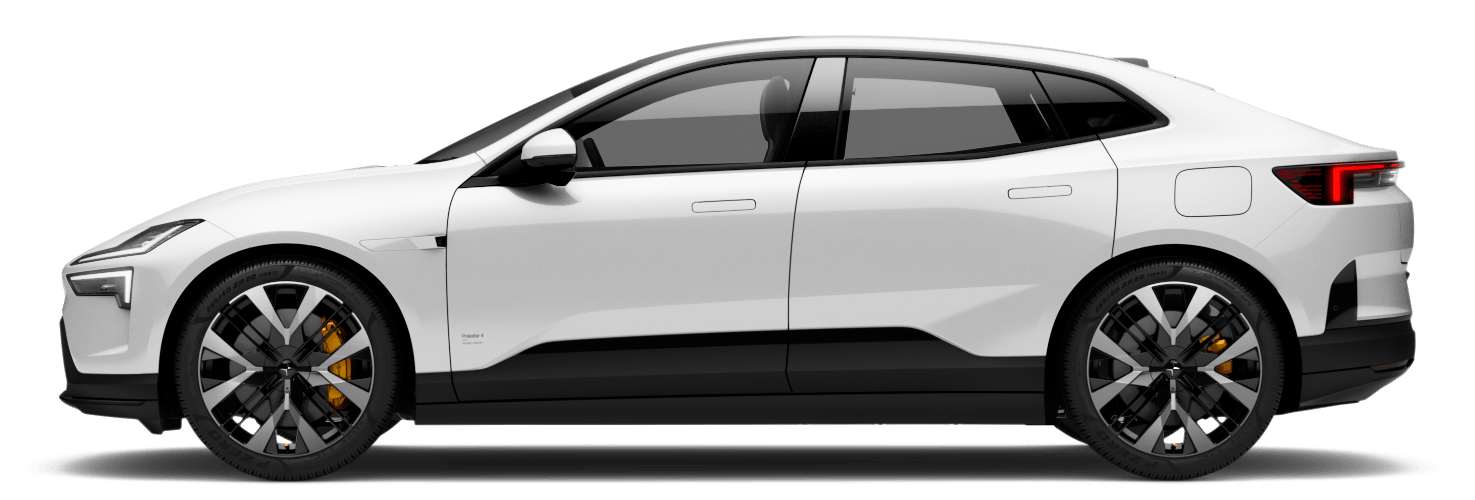

Benefit-in-kind (BIK) tax rates are set, in part, by a car’s CO2 emissions. The 100% electric Polestar 2 and Polestar 3 emit zero tail-pipe emissions, meaning they qualify for the lowest ‘band’ at only 2%. Even better, this will remain at 2% until 2025. By comparison, BIK tax is set to a minimum of 15% for petrol and diesel cars.

Polestar Life Cycle Assessment

Sustainability is a core component of the Polestar brand. To enable other brands who share our values to make the best decisions, we produce a fully transparent life cycle assessment for each of our cars. This detailed report builds a clear picture of where our cars succeed in bringing sustainable change.

100% write-down allowance in year one

Currently, electric vehicles purchased in the UK by organisations can qualify for a 100% write-down during the first year of ownership. This means you can reduce the amount of tax you pay. See below for a guide using the Polestar 3 and Polestar 2 as examples.

Purchase price (net of VAT) | |

£40,801 | £66,766 |

CO2 emissions | |

0g/km | 170g/km |

Capital allowances (year one) | |

100% | 6% |

Write down allowance | |

£40,801 | £4,006 |

Example pre-tax profit | |

£100,000 | £100,000 |

Taxable profit | |

£59,199 | £95,994 |

Corporation tax rate | |

25% | 25% |

Corporation tax bill | |

£14,800 | £23,999 |

Net profit | |

£85,200 | £76,001 |

Follow the steps below to purchase a Polestar through your business.

Follow the steps below to purchase a Polestar through your business.

- 01.Configure your Polestar

Configure a Polestar that fits your requirements from our new car configurator or, for faster delivery, explore our selection of Available Cars or Pre-owned Polestars. When purchasing, select 'business customer' and 'direct payment / other financing'.

Configure - 02.Choose how you'd like to buy

Outright purchases are available through our digital journey. This means you can arrange everything from the comfort of your own home (or office). Polestar Loan products such as Personal Contract Purchase (PCP) or Polestar Purchase Plan can be arranged by contacting Polestar Finance.

Contact Polestar Finance on 0330 678 1548.

- 03.Reserve your car and follow the instructions

Depending on how you've chosen to purchase your Polestar, you'll receive a bespoke set of instructions from us. Either way, we'll be in touch with all that you need to know.

- 04.Accept your handover

We’ll be in touch before your order arrives to update you on its progress. As the big day draws near, we’ll reach out asking you to accept a handover date. Once that’s done, welcome to the Polestar Universe.

Please contact Polestar Support on 08081348372 if you have any queries. We're happy to help.

Please contact Polestar Support on 08081348372 if you have any queries. We're happy to help.